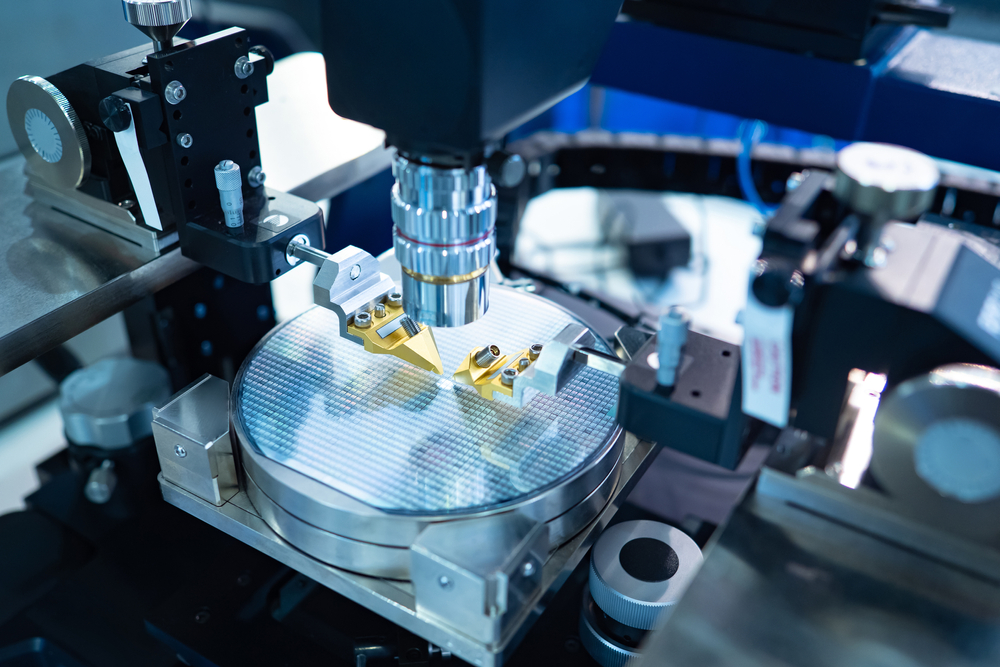

Supply chain disruptions in chip delivery, coupled with the energy crisis in key producer China mean the Kingdom’s retailers could face lower availability of products, a Saudi investment bank said in a report.

Al Rajhi Capital explained that chip shortages will hamper the production and distribution of electronic devices.

The lead time for the delivery of chips – which is the amount of time between order placement and delivery – rose to 21.7 weeks in September 2021, significantly up from the previous year’s average of 12.6 weeks.

The firm expects this disruption to continue through 2022, hindering Saudi retailers’ revenues due to a lower availability of products.

Apple is set to reduce its production of iPhone 13 to 80 million units in the fourth quarter of 2021, down from an earlier estimate of 90 million phones.

However, the Riyadh-based firm pointed out that, due to costlier mortgage-related payments, consumption patterns are changing in the Kingdom, with a noticeable shift towards entertainment and education, among others.

This, in turn, could mean that consumers’ might assign a lower share of their purchases towards electronic devices.

The company projects that mortgage loan growth would outpace other consumer borrowing, resulting in a lower share of expenditures on non-essentials.

Three companies that Al Rajhi Capital says will be affected by these developments are: Al-Hokair, Jarir and Extra.

Al-Hokair could face lower purchases of expensive clothing, as consumers shift their expenditure towards mortgages, while Jarir and Extra are expected to be impacted by lower revenues from electronics.

Chip shortages, China’s energy crisis could hamper Saudi retail sector: Al Rajhi Capital

Source: Viral Real Articles

0 Mga Komento